In the absence of a galvanizing narrative, America is marching towards the abyss...

THE NOTION that the very same economic forces currently plaguing Greece et al are somehow not relevant to America does not hold water. As goes the rest of the world, so goes the US,

writes Chris Martenson.

When we back up far enough, it is clear that money and debt are there to reflect and be in service to the production of real things by real people, not the other way around. With too much debt relative to production, it is the debt that will suffer. The same is true of money. Neither are magical substances; they are merely markers for real things. When they get out of balance with reality, they lose value, and sometimes even their entire meaning.

The US is irretrievably down the rabbit hole of deficits and debt, and that, even if there were endless natural resources of increasing quality available at this point, servicing the debt loads and liabilities of the nation will require both austerity and a pretty serious fall in living standards for most people.

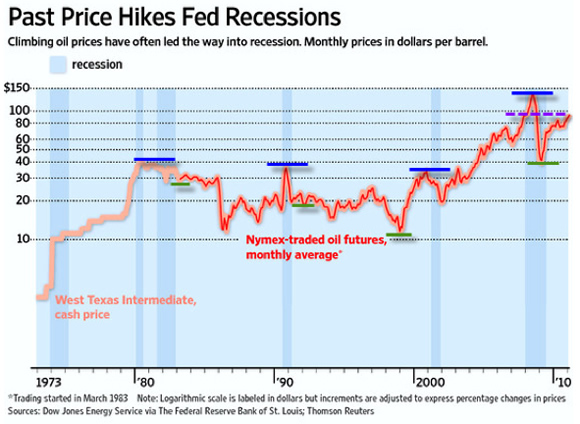

Of course, the age of cheap oil is over. And as Jim Puplava says, the oil price is the new Fed funds rate, meaning that it is now the price of oil that sets the pace of economic movement, not interest rates established by the Fed.

However, of all the challenges that catch my eye right now, the one most worrisome is the shredding of our national narrative to the point that it no longer makes any sense whatsoever. I'm a big believer that our actions are guided by the stories we tell ourselves. To progress as a society, having a grand vision that aligns and inspires is essential.

But when words emphasize one set of priorities and actions support another, any narrative falls apart. At a personal level, if someone touts their punctuality but chronically shows up hours late, the narrative that says "this person is reliable" begins to fall apart.

Likewise, if a company boasts about being green but its track record belies them as a major polluter, the "green" narrative fizzles.

And at the national level, if we say we are a nation of laws, but the Justice Department selectively prosecutes only the weak and relatively powerless while leaving the well-connected and moneyed entirely alone, then the narrative that says "we are a nation of blind justice and equal laws" falls apart.

I wish this was just some idle rumination, but I see more and more examples validating the importance of alignment of narrative and behavior. Because when there is a disconnect between words and actions, anxiety and fear take root.

Unfortunately, there is quite a lot to fear and be anxious about in the most recent State of the Union address and GOP response.

The recent State of the Union speech by Obama, and its Republican response, are both remarkable for what they say as well as what they don't say. The summary is this: The status quo will be preserved at all costs.

Here are a few examples of the sorts of disconnects between rhetoric and reality that are absolutely toxic to the morale of all who are paying the slightest bit of attention.

Obama

Let's never forget: Millions of Americans who work hard and play by the rules every day deserve a government and a financial system that do the same. It's time to apply the same rules from top to bottom. No bailouts, no handouts, and no copouts. An America built to last insists on responsibility from everybody.

We've all paid the price for lenders who sold mortgages to people who couldn't afford them, and buyers who knew they couldn't afford them. That's why we need smart regulations to prevent irresponsible behavior.

It's time to apply the same rules from top to bottom? Is Obama aware of what Erik Holder is up to over there in the Justice Department? The robo-signing scandal alone has thousands and thousands of open and shut cases of felony forgery that can and should be applied to as many individuals as were directly involved, from top to bottom in every organization that was engaged in the practice.

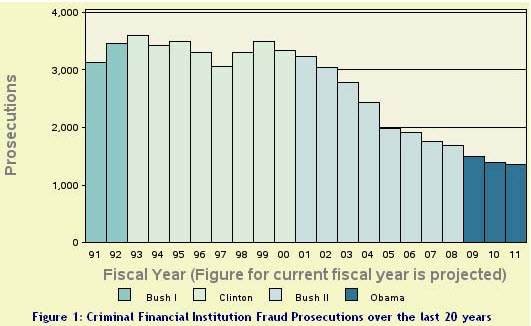

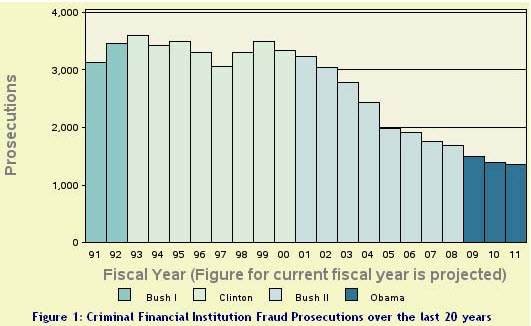

Here's the reality. Under Obama, criminal prosecution of financial fraud fell to multi-decade lows during what is and remains one of the most target-rich environments in living memory.

(

Source)

Obama

And I will not go back to the days when Wall Street was allowed to play by its own set of rules.

So if you are a big bank or financial institution, you're no longer allowed to make risky bets with your customers' deposits. You're required to write out a "living will" that details exactly how you'll pay the bills if you fail – because the rest of us are not bailing you out ever again.

Has Obama checked with the Federal Reserve to assure they are on board with the new 'no bail out' policy? Because last I checked, they were the ones mainly involved in bailing out the big banks and providing swap lines and free credit to anyone and everyone that needed help, US or foreign.

To be fair, Obama can make no statement or claim about what the Federal Reserve can or can't or will or won't do. It is not under executive nor even legislative control. If, or I should say when, the Federal Reserve bails out the next bank or country or whomever, it's "the rest of us" who will be paying the bill – in the form of eventual inflation.

Obama

[W]orking with our military leaders, I've proposed a new defense strategy that ensures we maintain the finest military in the world, while saving nearly half a trillion Dollars in our budget.

Let's review the proposals for military spending then. The language above is nearly impossible to decode. What is really being said is that proposed defense increases have been scaled back, and that this is what is being called savings.

In 2000, Defense spending was $312 billion Dollars. In 2012, the proposed budget calls for $703 billion, a 125% increase in 12 years.

What the plan he mentions really calls for is spending increases in 5 out of the next 6 years. The lone holdout is 2013, when the plan calls for cutting spending by a whopping $6 billion less than the amount already approved for 2012.

Somehow that all translates into rhetoric that implies cuts of "nearly half a trillion Dollars."

As Lily Tomlin used to say, "As cynical as I am, I find it hard to keep up."

GOP Response

"The routes back to an America of promise, and to a solvent America that can pay its bills and protect its vulnerable, start in the same place. The only way up for those suffering tonight, and the only way out of the dead end of debt into which we have driven, is a private economy that begins to grow and create jobs, real jobs, at a much faster rate than today."

This platitude-laden set of ideas is blissfully blind to the role of energy in the story, the amount of debt in the system, and the fact that both parties have contributed equally over the years to the predicament at hand.

How exactly is it that the private economy is supposed to flourish here, with the Federal government borrowing more than a trillion Dollars a year and oil at $100 per barrel? The simple truth is that the US government needs to begin borrowing at a rate lower than the previous year's economic growth. If GDP grows at 2%, then the total debt pile must not grow by anything more than 2%. That is the only way that the official debts can shrink relative to the economy.

GOP Response

"We will advance our positive suggestions with confidence, because we know that Americans are still a people born to liberty. There is nothing wrong with the state of our Union that the American people, addressed as free-born, mature citizens, cannot set right."

Last I checked, the original vote tally in the Senate on the National Defense Authorization Act, which empowered the armed forces to engage in civilian law enforcement activities and selectively suspended the habeas corpus and due process rights (as guaranteed by the 5th and 6th amendments to the Constitution), passed by a voice vote of 93 to 7 in the Senate.

It's kind of hard to swallow the idea that the GOP stands with Americans as "a people born to liberty" when their members are in perfect lock-step with the Democrats, chipping away at the most basic and cherished freedoms. There's no difference between the parties when both seem intent on limiting individual freedom and increasing the power of the government to reach into and examine our daily lives.

The above examples are not meant to pick on any one person or party or set of ideas, but to illuminate the profound gap that exists between what we are telling ourselves at the national level and the actions we are undertaking.

Again, it is the gap between what we tell ourselves and what we do that creates a sense of unease, anxiety, and oftentimes fear. When we hear words "X" but see actions "Y" over and over again, it is hard not to come to the conclusion that the words are meaningless; empty rhetoric designed with polls and focus groups in mind, but little else.

It is the blind obedience to the status quo that worries me the most, as it raises the likelihood that nothing of any substance will be done until forced by circumstances, at which point, like Greece, we will discover that the remaining menu of options ranges from bad to worse.

In neither Obama's address nor the GOP response do we hear anything about Peak Oil, a stock market that has gone nowhere in ten years, or the fact that with two wars winding down there ought to be massive savings from defense cuts that we can capture. There's lip service to the idea of using more natural gas to begin weaning us off our imported oil dependence, but no commensurate trillion-Dollar program offered to rapidly build out the infrastructure necessary to utilize that gas in a meaningful way.

A more honest set of messages would note that mistakes were made, opportunities squandered, and priorities misplaced. It would note that the US is on an unsustainable course with respect to spending, debts, and liabilities. There would be an explicit admission that having your central bank print trillions in "thin air" money in order to enable runaway deficit spending is a dangerous and foolish thing to entertain.

Most obviously missing is a national narrative that is coherent and comports with the facts. Both parties basically imply that if we elect a few more of their type, do a little of this and then tweak a little of that, then we will get our nation back on track.

There is no call to a shared sacrifice for something greater. There is nothing to rally around except a laundry list of disconnected programs; a little something for everyone. There is no overarching theme under which everything else can be hung, such as a space race, a civil rights movement, or a massive upgrading of our national infrastructure.

A good narrative is one that inspires people and is based in reality but also asks something larger of us that we can share in. What is our vision for this country? Where do we want to be in ten years? How about twenty? How will we get there, and what will be required? What should we stop doing, what should we start doing, and what should we continue doing?

None of these things are on display, and all are badly needed if we are going to make the most of the next twenty years.

Of all the facts that got skimmed over or avoided in the State of the Union extravaganza, the fiscal nightmare in DC was probably the most glaring. Yes, both parties have decided to talk about the deficit, but neither is giving the appropriate context.

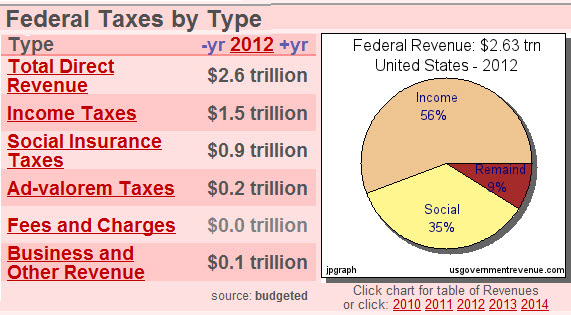

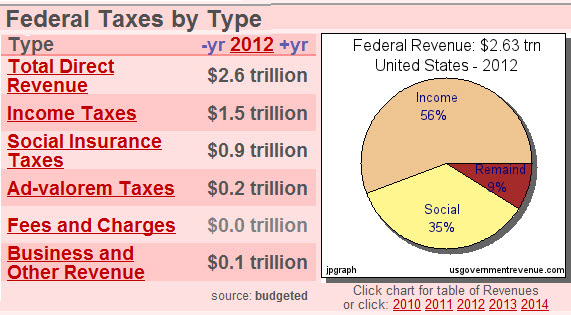

For FY 2012, the federal government is projected to run a $1.1 trillion deficit. Let's compare that number to the projected revenues:

(

Source)

The $1.1 trillion deficit is 42% of total revenues and 73% of all income taxes. That is, in order to spend what the US currently spends without going further into debt (i.e., to have no deficit), income taxes must immediately increase by 73%(!).

This is the sort of territory that, were the US any other country, would have already landed its debt markets – and likely its currency, too – in very hot water.

Historically, countries that have run deficits 40% greater than revenue for more than two years have experienced profound financial and political crises. The US is now in its fourth year of inhabiting this rare territory.

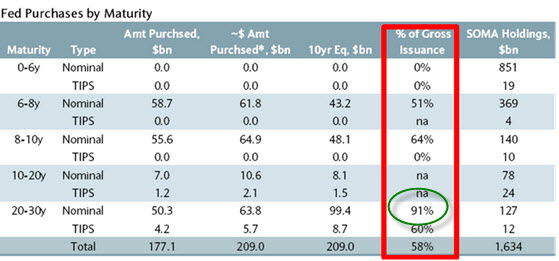

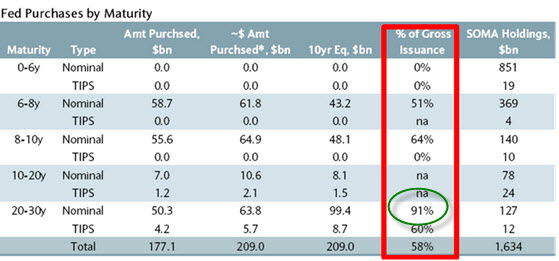

How can it keep doing this when every other country that has tried has gotten into trouble? Simple. The Federal Reserve has enabled such egregious deficit spending by buying up mind-boggling amounts of government debt. This has both kept rates low and created a lot of additional buying demand for Treasuries.

Exactly how much US debt is the Fed buying? Under Operation Twist, the Fed has bought anywhere from 51% to 91% of all gross issuance of bonds dated six years or longer in maturity.

(

Source)

It is quite obvious that the Fed has been a major participant in the bond markets and a major reason why Treasurys are priced so high and offer so low a yield.

It seems that it is well past time to speak directly to the enormous fiscal deficits in a credible way, not merely bemoaning them being too high. And we're also overdue for an adult national conversation that it's unwise and unsustainable for a country to lean on its central bank to print up the difference between receipts and outlays.

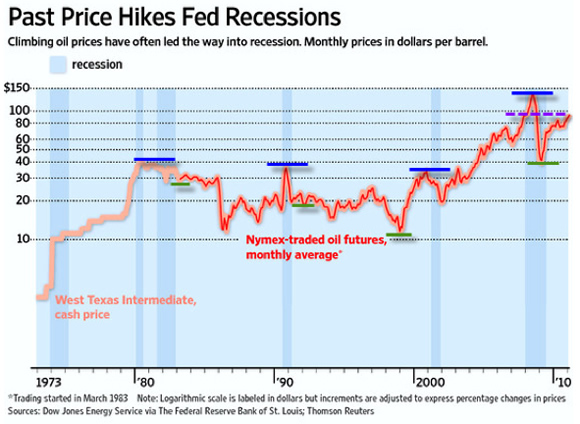

There is a clear relationship between high oil prices and recessions, confirming the idea that the price of oil has the same impact on the economy as higher interest rates (perhaps even more so nowadays). Both are a source of friction. With higher interest rates, less lending and less consuming happens. With a higher price of oil, more money gets spent on energy, much of it sent to foreign producers of oil, and thus less money is available for other consumption.

Both higher oil prices and higher interest rates cause people to think a bit more before pulling the trigger on either ordinary spending or a big capital project.

Note that all of the six prior recessions were preceded by a spike in oil prices. In the case of the double-dip 1980s twin recessions, oil remained elevated after the first recession was (allegedly) over. Don't be fooled by the logarithmic nature of the chart below – note that the typical decline in oil prices between the recession-inducing peak (blue lines) and the recovery-enabling trough (green lines) was a substantial 30%-50%:

(

Source)

Also note in the most recent data that oil prices happen to be at roughly the same level that triggered the first recession in 2008 (the purple dotted line).

If we needed one simple chart to help us understand why trillions of Dollars of stimulus and handouts are not causing the economy to soar, this is the chart that explains the most. High oil prices and recessions are highly correlated, and it's not too much of a stretch to postulate that economic recoveries and high oil prices are inversely correlated.

Note also that the above chart is not inflation-adjusted. If it were, it would show that there have been exactly zero recoveries when oil prices are near or over $100 per barrel.

For those counting on an economic recovery here to lift all boats and assist the bailout efforts, the burden of history is upon them to explain why this time we should ignore the price of oil.

I say we cannot. Policy planners and citizens alike should be ready for disappointing market and economic activity in response to the usual bag of printing, borrowing and delaying tricks.

The State of the Union speech and GOP response neither accurately portray the true fiscal condition of the US, nor present a compelling narrative that speaks either to the realities of today or a future we might like to head towards.

The US is simply on a fiscally ruinous path, and neither party seems up to the task of laying out the story in a way that is mature, clear, and direct.

No recovery has ever been possible from oil prices this high, nor with debt levels this extreme, and it is quite improbable to think that both conditions could be overcome with anything less than a completely clear-eyed view of the true nature of the predicament faced.

Decades ago, Ludwig Von Mises captured everything discussed here elegantly:

There is no means of avoiding the final collapse of a boom brought about by credit expansion.

The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

Our current dire fiscal condition, our leaders' dysfunctional unwillingness to address the flawed behavior that caused it, plus many other recent events both in the US and in Europe, point to the idea that a voluntary abandonment of further credit expansion is just not on the menu.

That leaves us with some final and total catastrophe of the involved currency system(s) as the inevitable outcome.

At this point, time to prepare is your greatest asset. But as we can see from the precarious global economic situation described above, time is running out. Use what remains wisely.

Considering Buying Gold? Buy and own – outright – physical Allocated Gold stored at low cost in your choice of US, UK or Switzerland vaults when you buy through BullionVault...